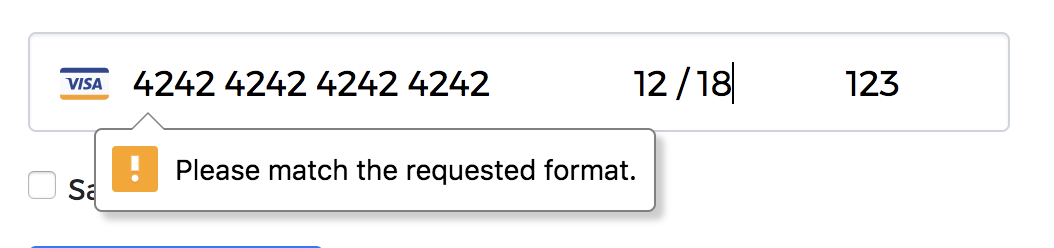

Invalid value for field credit card number

Invalid value for field credit card number

Question: Q: credit card number is invalid

Posted on Jul 21, 2017 9:29 AM

All replies

Loading page content

Page content loaded

They know what type of card by the first 4 digits of the card. That is an industry standard to help eliminate fraud.

Jul 21, 2017 9:31 AM

The card type says visa up until I put in one of the digits from the last block of 4 but if I change the one number that makes it become an unknown card type to a wrong number it says that I’m using a Visa card so not sure what’s up with that

Jul 21, 2017 9:39 AM

You have likely added too many cards to your account. Apple monitors how often you switch the card associated with your account and will not let you add a new one for a couple of months. Just keep the one you already had on there or use an iTunes card.

I am certain that is the issue, assuming you have already verified that no other issue exists, with you bank.

Are you holding the card in your hand when you type? Did you try scanning? I get the sense you may not have the physical card with you.

In HTML forms, we often required validation of different types. Validate existing email, validate password length, validate confirm password, validate to allow only integer inputs, these are some examples of validation. In a certain input field, only valid credit card numbers are allowed i.e. there not allowed any other string or number which not follow the rule to be a valid credit card. We can also validate these input fields to only accept a valid credit card number using express-validator middleware.

Condition to be a valid credit card number:

Credit card number must follow the Luhn’s algorithm as shown below:

The Luhn Formula:

Example:

Original Number: 4 5 5 6 7 3 7 5 8 6 8 9 9 8 5 5

Drop the last digit: 4 5 5 6 7 3 7 5 8 6 8 9 9 8 5

Reverse the digits: 5 8 9 9 8 6 8 5 7 3 7 6 5 5 4

Multiple odd place digits by 2: 10 8 18 9 16 6 16 5 14 3 14 6 10 5 8

Subtract 9 to numbers over 9: 1 8 9 9 7 6 7 5 5 3 5 6 1 5 8

Add all numbers: 1 8 9 9 7 6 7 5 5 3 5 6 1 5 8 = 85

Mod 10: 85 modulo 10 = 5 (last digit of card)

Command to install express-validator:

Steps to use express-validator to implement the logic:

Note: Here we use local or custom database to implement the logic, the same steps can be followed to implement the logic in a regular database like MongoDB or MySql.

Example: This example illustrates how to validate an input field to only allow a valid credit card number.

Error Code 14: Invalid Card Number

Date Updated: Nov 19 2021

Caroline McMullen 2 min read

If you run a credit card and see an error code pop up, it may be error code 14. Oftentimes when you get an error code, it’s because of a problem with the credit card issuer. Depending on the situation, the error code you see may be the difference between making the sale and having to turn the customer away. One code that appears more often than not is error code 14, which denotes an invalid card number. Read on to learn more about what error codes are, what credit card error code 14 means, and how to resolve it.

What is an Error Code?

When a payment processor cannot process a transaction, they return a credit card decline code, hold code, or error code.

There are several reasons why a credit card transaction may fail to go through, each with its own corresponding code. Error codes help terminal users because they can look up the code, find out the cause of the error or decline, and use that information to figure out the best solution.

Some common causes for error codes include fraudulent activity, running a card several times in a short period, incorrect information, or other similar issues. If you accept credit and debit cards, you must arm yourself with the knowledge of how to handle error codes so you can help your customers and complete your sales.

Invalid Card Number: What Does It Mean?

You may be asking yourself, what is an error code 14? Error code 14 simply means an invalid card number was entered. It is one of the most common error codes that appear, and one of the easiest to fix. It often means the terminal user made a small mistake when keying in the card information, and one or more digits are incorrect.

The invalid number could be the actual credit card number, expiration date, zip code, or CVV. Whichever number it is, error code 14 signals it has been incorrectly entered.

How to Clear Your Error Code 14

Clearing credit card error code 14 is very easy to do. Simply re-enter the credit card number carefully and accurately, and the error code should not come up again. With the right card number, the transaction can now go through and you can complete the sale. Compared to other error codes, this is a quick fix. Many result in a customer being unable to purchase their item until they speak with their card issuer.

If your payment processor declined a transaction due to error code 14, there is no need to fret. Now you know what an error code is and just how to resolve it. With this information, you can guide your customer as you resolve the problem with ease.

Caroline is a writer and editor based in Los Angeles, CA. She has been working in the writing sphere for the last five years, covering everything from breaking news to lifestyle features, and now digital payments. Caroline is currently a Marketing Coordinator at PaymentCloud, a merchant services provider that offers hard-to-place solutions for business owners across the nation.

7 Reasons for Cash App Invalid Card Number – Fix “Invalid Card” error

A Cash App invalid card number means that the card is not valid. The bank that issued the card has apparently blocked it. If not, check if you are entering the correct Card details, CVV, name, Card is not authorized for Internet transactions, not activated and the Card is not supported by Cash App.

Does Cash App keep saying “invalid card number” each time you attempt registering your debit card in the app?

Continue reading to learn more about the topic.

Cash App is a fantastic user-friendly platform that’s great for sending and receiving funds, as well as making payments for purchases.

However, while using Cash App, you might face a Cash App “invalid card number” glitch, which is getting in your way of enjoying the amazing services the app offers. Linking your card and bank account makes it easier to fund your Cash App wallet.

This article will walk you through the reasons your card is said to be invalid. We’ll also show you what to do if you can’t link your card on the app.

So, without further ado, let’s delve in!

What Does “Invalid Card Number” Mean?

An “invalid card number” pop-up is essentially trying to tell you that your card is probably closed by the issuer.

But if the card isn’t closed, then why is Cash App saying your card number is invalid?

Why Is Cash App Saying “Invalid Card Number”?

There may be various reasons you’re unable to link your debit card to your Cash App and hence receive “invalid card number” messages. Let’s have a look at some of them.

1. The Card Is Expired

If you’re having trouble linking your debit card to Cash App, then you should check if your card has expired or not.

You may have noticed a date on the front of your debit card. That date is the expiration date of your card.

Usually, cards are valid for three to four years after the date of issue.

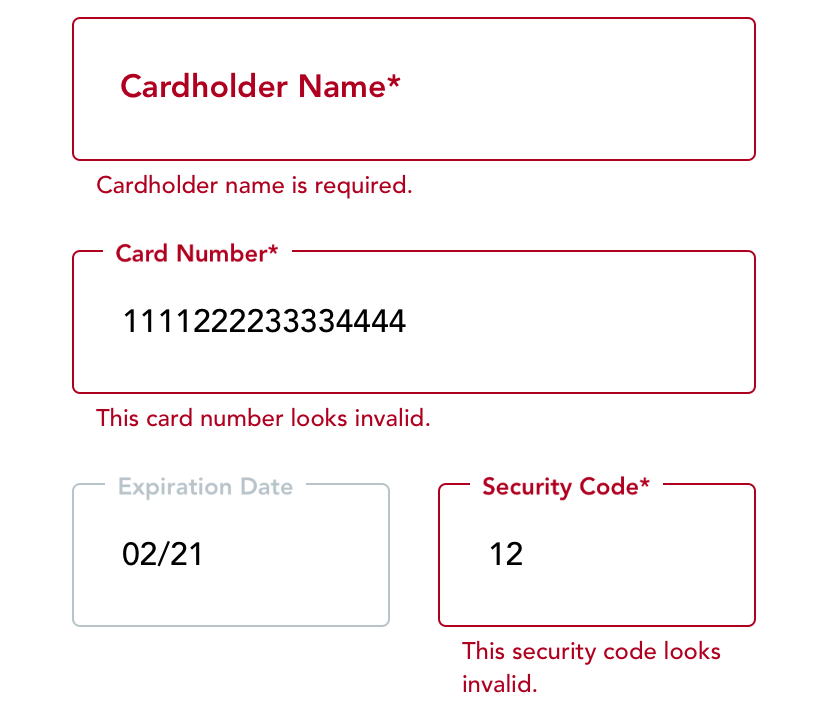

2. You May Be Entering the Wrong Card Details

This is a common cause of most Cash App debit card declines.

You need to enter the card details more carefully and make sure that you don’t make any errors.

Here are a few details on your card that you could be entering wrong into Cash App.

The Card Number

The card number is made up of 16 digits. Considering the number of characters, it can be very easy to swap digits while entering them.

After entering the numbers, go over them before hitting the submit button.

CVV Number

Aside from the card number, you can also enter the wrong CVV number. CVV (Credit Verification Value) is a security feature common with banking transactions.

The CVV number is a set of 3 to 4 digits normally found on the back of your card. It’s sometimes called the card verification code or a security code.

Expiry Date

Your card’s expiration date is imprinted on the front of it, written in the month/year format.

Entering the date in the right format is as important as entering the right digits.

Card Holder Name

The last detail is the card holder’s name which is boldly imprinted on the front of the card.

You shouldn’t include names that aren’t on the card, and the names must be entered in the right order, as well.

3. Your Card Isn’t Activated

If you order a new card and attempt to add the non-activated card to Cash App, the app can decline your card.

You can contact your bank to guide you through the activation process or when you run into any glitches while doing so.

4. Cash App Doesn’t Support Your Card

Cash App doesn’t accept PayPal, business debit, or ATM cards. Therefore, you’ll be sent an “invalid card number” notification if you try to link cards from these providers.

5. You Have Linked the Wrong Bank Account

Linking the wrong bank account may be another reason Cash App is stopping you from going through with your card linking process.

Make sure you have linked the bank account connected to your debit card before you attempt to register the card in the app.

6. Your Card Isn’t Authorized for Internet Transactions

Cash App can also decline your card if it hasn’t been authorized for a particular type of internet transaction.

For example, some cards are only allowed to be used for specific transactions like healthcare. If that may be the problem, then contacting your bank about it is the best option.

7. Your Application Is Outdated

Cash App might give you the “invalid card number” message if the app’s version is outdated. So make sure to update Cash App on your device.

After you update your Cash App version, clear the app’s cache and data using the following steps:

If you’ve tried everything and the issue persists, the next thing to do is to contact your bank. It might have a solution to your problem.

However, if the bank tells you that everything is clear from its side, then your only option is to contact Cash App Support.

How to Contact Cash App Support

You can contact Cash App through the application by visiting the “Support” section. The following steps will help you:

You can also reach Cash App by calling 1(800) 969-1940.

Last Words

There are many features and services available to explore on Cash App. However, you may also face issues like linking your card, among many others.

In all, we learned what it means when we get an “invalid card number” message from Cash App.

We have also explained the actions and inactions that can cause Cash App to decline our cards and how we can fix them.

Why do I see ‘Invalid Credit Card Number’ when trying to enter a credit card or pay my bill?

Issue

Your invoice payment has been declined and you are receiving the message ‘Invalid Credit Card Number’ on your Dashboard.

Resolution

When you select Pay Now in the Billing section of your Dashboard, you may receive the message Invalid Credit Card Number. This indicates a problem with the information entered for the card. Double-check the credit card number, expiration date, and CVV. If you haven’t already, also ensure that the card has been activated.

Billing address (AVS) discrepancies will not usually cause this error message. However, if the card is from outside of the US, you may be receiving this error message due to address formatting. Pay close attention to the way you enter your billing address differs from the way it appears on your statement your bank. This includes ensuring the separation of Line 1 and Line 2 of the address.

Alternatively, some banking institutions may be screening vendors like Heroku for security reasons and blocking the transaction. In this case, we recommend speaking to your bank about allowing Heroku transactions to be accepted.

Please view our knowledge base article on card declines for more information:

Ask on Stack Overflow

Engage with a community of passionate experts to get the answers you need

Heroku Support

Create a support ticket and our support experts will get back to you

Credit Card Number Validation Using jQuery

Today we are going to understand, how to do credit card number validation using jQuery. Most of the eCommerce website use transaction via credit card. Than you always need credit card number validation at client side.

We are using an HTML form to validate credit card input data. When user submit information via form than the jQuery code will be called to validate it.

For this validation we are using jQuery Credit Card Validator library. This library will detect credit card type, length and validate the card type.

How jQuery Credit Card Validator Plugin Works:

jQuery Credit Card Validator is a jQuery plugin which will take input as a card number returns an object with four properties. Check out below object properties explanation:

– card_type — Return an object with described below properties, or null if card type unknown

– valid — Return true if the number is valid, otherwise gives false

– length_valid — Return true value if the card number length is valid, false otherwise

– luhn_valid — Return true if the Luhn checksum is correct, otherwise false

Include jQuery & Credit Card Validator Library:

Include the jQuery library in HTML form page.

Include the Credit Card Validator jQuery library to validate card number.

Now write down an HTML form code to take credit card input. Initialize the input card number text by for validation library.

Cybersource Developer Community Cybersource Developer Community

We encountered the following error in our production logs:

Result code: null; Message: The field length is invalid for Card Number.

Our UI validation enforces the credit card length to be between 13 and 16 characters, as documented on the authorize.net website.

Are there additional validations performed on the payment gateway side when an account is in PRODUCTION mode compared to a TEST account? Do we have to match the length of the credit card to the credit card type? For example, if a customer has a VISA card, but enters less than 16 characters, does that throw the above exception? If so, shouldn’t it be the same in a TEST account?

Any help is greatly appreciated.

VISA, for instance, always starts with a 4 and always has 16 digits.

I entered the test VISA card number I received from Authorize.Net when I signed up for a test account. The card number is 13 digits long and I was able to create an account in CIM.

Then, I used the same card number, but added a «9» at the end. So the card number length was 14 digits and it still worked.

Looks like it doesn’t match the card type to the card number length. However, could there be a difference between a test account and a production account? Are production accounts stricter in verifying valid cards / types?

There are multiple ways we validate the card number, but the length is not one of them because it is not formally specified by the card companies. Every Visa card you ever see may be 16 digits, but there is nothing in their standards that says a 15 digit Visa is absolutely invalid.

We primarily validate the following:

1. We perform a mod-10 mathematical check on the card number to confirm that it at least has the possibility of being valid.

2. We confirm that the bin number (first 6 digits of the card) is valid and assigned to one of our supported card types. It is the BIN number that tells us the card type.

Things that are validated on production accounts are the card number (making sure its valid), expiration date (needs to be a future date), the card code and address—both will be verified if your settings are set to check this (Merchant Interface-Account tab-Security Settings- you will see AVS and Card Code Settings). You do not need to match the length of the credit card to the card type because you don’t need to pass the card type—it is automatically determined based on the credit card number entered.

braintree/card-validator

Use Git or checkout with SVN using the web URL.

Work fast with our official CLI. Learn more.

Launching GitHub Desktop

If nothing happens, download GitHub Desktop and try again.

Launching GitHub Desktop

If nothing happens, download GitHub Desktop and try again.

Launching Xcode

If nothing happens, download Xcode and try again.

Launching Visual Studio Code

Your codespace will open once ready.

There was a problem preparing your codespace, please try again.

Latest commit

Git stats

Files

Failed to load latest commit information.

README.md

Credit Card Validator

Credit Card Validator provides validation utilities for credit card data inputs. It is designed as a CommonJS module for use in Node.js, io.js, or the browser. It includes first class support for ‘potential’ validity so you can use it to present appropriate UI to your user as they type.

A typical use case in a credit card form is to notify the user if the data they are entering is invalid. In a credit card field, entering “411” is not necessarily valid for submission, but it is still potentially valid. Conversely, if a user enters “41x” that value can no longer pass strict validation and you can provide a response immediately.

Credit Card Validator will also provide a determined card type (using credit-card-type). This is useful for scenarios in which you wish to render an accompanying payment method icon (Visa, MasterCard, etc.). Additionally, by having access to the current card type, you can better manage the state of your credit card form as a whole. For example, if you detect a user is entering (or has entered) an American Express card number, you can update the maxlength attribute of your CVV input element from 3 to 4 and even update the corresponding label from ‘CVV’ to ‘CID’.

Using a CommonJS build tool (browserify, webpack, etc)

var valid = require(‘card-validator’);

valid.number(value: string, [options: object]): object

You can optionally pass luhnValidateUnionPay as a property of an object as a second argument. This will override the default behavior to ignore luhn validity of UnionPay cards.

You can optionally pass maxLength as a property of an object as a second argument. This will override the default behavior to use the card type’s max length property and mark any cards that exceed the max length as invalid.

If a card brand has a normal max length that is shorter than the passed in max length, the validator will use the shorter one. For instance, if a maxLength of 16 is provided, the validator will still use 15 as the max length for American Express cards.

A fake session where a user is entering a card number may look like:

| Input | Output | Suggested Handling | |||

|---|---|---|---|---|---|

| Value | card.type | isPotentiallyValid | isValid | Render Invalid UI | Allow Submit |

| » | null | true | false | no | no |

| ‘6’ | null | true | false | no | no |

| ’60’ | ‘discover’ | true | false | no | no |

| ‘601’ | ‘discover’ | true | false | no | no |

| ‘6011’ | ‘discover’ | true | false | no | no |

| ‘601’ | ‘discover’ | true | false | no | no |

| ’60’ | ‘discover’ | true | false | no | no |

| ‘6’ | null | true | false | no | no |

| » | null | true | false | no | no |

| ‘x’ | null | false | false | yes | no |

| » | null | true | false | no | no |

| ‘4’ | ‘visa’ | true | false | no | no |

| ’41’ | ‘visa’ | true | false | no | no |

| ‘411’ | ‘visa’ | true | false | no | no |

| ‘4111111111111111’ | ‘visa’ | true | true | no | yes |

| ‘411x’ | null | false | false | yes | no |

valid.cardholderName(value: string): object

The cardholderName validation essentially tests for a valid string greater than 0 characters in length that does not look like a card number.

If a cardholder name is comprised of only numbers, hyphens and spaces, the validator considers it to be too card-like to be valid, but may still be potentially valid if a non-numeric character is added. This is to prevent card number values from being sent along as the cardholder name but not make too many assumptions about a person’s cardholder name.

If a cardholder name is longer than 255 characters, it is assumed to be invalid.

valid.expirationDate(value: string|object, maxElapsedYear: integer): object

The maxElapsedYear parameter determines how many years in the future a card’s expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

expirationDate will parse strings in a variety of formats:

| Input | Output |

|---|---|

| ’10/19′ ’10 / 19′ ‘1019’ ’10 19′ | |

| ’10/2019′ ’10 / 2019′ ‘102019’ ’10 2019′ ’10 19′ | |

| ‘2019-10’ | |

| | |

valid.expirationMonth(value: string): object

valid.expirationYear(value: string, maxElapsedYear: integer): object

expirationYear accepts 2 or 4 digit years. 16 and 2016 are both valid entries.

The maxElapsedYear parameter determines how many years in the future a card’s expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

valid.cvv(value: string, maxLength: integer): object

The cvv validation by default tests for a numeric string of 3 characters in length. The maxLength can be overridden by passing in an integer as a second argument. You would typically switch this length from 3 to 4 in the case of an American Express card which expects a 4 digit CID.

valid.postalCode(value: string, [options: object]): object

The postalCode validation essentially tests for a valid string greater than 3 characters in length.

You can optionally pass minLength as a property of an object as a second argument. This will override the default min length of 3.

Custom Card Brands

We use nvm for managing our node versions, but you do not have to. Replace any nvm references with the tool of your choice below.

Validating and Formatting Payment Card Text Fields in Flutter

I am going to walk us through the steps of validating payment (debit/credit) cards number, expiry date and CVV. Among other things, this is basically building on the already existing features of the TextFormField widget.

We’ll start with the card number: it will be validated and the appropriate icon of the issuer displayed.

Before, you continue, please make sure you know how to validate forms in Flutter.

Validating Payment Card Number, Determining its Issuer and Formatting the Text Field

Payment card numbers might appear random, but they actually follow a certain pattern. The length varies from 8 to 19 digits and while the authenticity of these numbers can be verified using the Luhn algorithm, the first six digits can be used to determine the card issuer. For example, numbers starting with 4 are issued by Visa while those issued by Verve starts from 5060, 5061, 5078, 5079, or 6500. You can check this Wikipedia page for the full article.

We’ll create an enumeration of all the card types we wish to support. For example purposes, I keep it down to just three viz. Verve, MasterCard and Verve.

We’ll also create a class to hold the fields of the card:

Now, we’ll create a TextFormField for entering the card number.

This function uses CardUtils.getCardTypeFrmNumber to determine the card issuer from the number already entered by the user.

CardUtils.getCleanedNumber uses regex to remove any non-digit from the inputted number. Confused? You thought that’s what WhitelistingTextInputFormatter. digitsOnly is supposed to do, right? I will explain later.

CardUtils.getCardTypeFrmNumber too uses regex to match the starting characters of the number against a pre-determined set of numbers:

After determining the card issuer, we use:

to update the widget state.

3. Next, CardUtils.getCardIcon returns the appropriate issuer icon. By now, you should have added image assets of the card types you’re supporting. Now, we’ll write a switch statement to check for the card types and return the appropriate widget.

In my project, images live in projectDirectory/assets/images.

5. The actual validation is done in validator. We’ll pull off this validation with Luhn’s algorithm:

To learn more about Luhn’s Algorithm and how it works, please check this stackoverflow answer.

Formatting Card Number Text Field

To improve readability, we can format the TextFormField to automatically add double spaces after every fourth character inputted by the user. Remember inputFormatters I talked about earlier? We will extend TextInputFormatter and add an instance of it to the list of inputFormatters we already have.

It’s pertinent to note that the extra characters added doesn’t add the length of the characters counted by LengthLimitingTextInputFormatter.

So inputFormatters for the TextFormField now becomes:

How to Validate Payment Card Expiry Date and Format the Text Field.

A valid expiry card is one whose month is from 1 to 12 (i.e. January to December) and whose year is not negative. Also, an unexpired date should be the be latter than this month or year. We should keep this in mind while validating the expiry date.

That’s the nitty-gritty of the TextFormField for inputting expiry month.

Part of the for loop is the only difference.

3. CardUtils.validateDate actually checks that the expiry date is valid and has not expired.

How to Validate Payment Card CVV and Format the TextField.

This is the simplest. Payments cards CVV is either 3 or 4 digits. It can’t be less/more than that.

CardUtils.validateCVV is quite straight forward. We just ensure that the value entered by the user is not empty and it’s not less than 3 or more than 4 digits:

Wrapping it all up

For easier validation, all the TextFormFields should be children of the Form widget.

Then throw in a button that does nothing but call _validateInputs :

I have pushed a project that you can clone and test out the above features. I also added support for more payments cards like Discover, American Express, Diners Club, and JCB.

Validate a Credit Card Number with Functional JavaScript

Credit card companies are responsible for a high volume of highly sensitive global network traffic per minute with no margin for error. These companies need to ensure they are not wasting resources processing unnecessary requests. When a credit card is run, the processor has to look up the account to ensure it exists, then query the balance to ensure the amount requested is available. While an individual transaction is cheap and small, the scales involved are enormous.

There were 39.2 million transactions per day in the UK alone in 2016. The linked analysis projects 60 million for that region by 2026. Clearly, anything that can reduce load is necessary to explore.

This is a beginner-level post. Some familiarity with JavaScript is assumed but not necessarily functional programming.

What’s In A Number

At a glance, a credit card number just appears to be a sequence of digits. You may have noticed that the major processing providers have their own prefixes. Visa cards all start with a 4, MasterCard with 5, Discover with 6, and American Express are 3 (and 15 digits instead of 16). Further, financial institutions will have their own 4-6 digit prefixes. People who work at point of sale systems or are otherwise involved with financial processing will notice these patterns quickly. For example, Discover credit cards start with 6011, a 4117 will be a Bank of America debit card, and 5417 is Chase Bank. This is known as the BIN, or Bank Identification Number. There’s a large list here.

However, this is all a network routing concern, and still adds to the network’s load to resolve. To try to ensure all lookup requests actually correspond to real accounts, all numbers have a checksum built in, which is a means of detecting errors in data. A credit card number consists of your card provider’s BIN attached to your individual account number, but the final digit is a checksum digit which can be used to validate for errors without ever querying a server.

Protip

«I’m a BIN and routing number encyclopedia» is a terrible party icebreaker. If you’ve really gotta flex this side of you, ease in with zipcodes or something first. Read the room.

Luhn algorithm

The specific type of checksum is called the Luhn formula, US Patent 2,950,048 (but public domain since 1977). To validate a number via the Luhn algorithm, you add a check digit. Then, after performing the formula on the original number, you see if this check digit corresponds to your result.

Split the full number into individual digits.

Start with the rightmost excluding the check digit and double every second, moving left.

If any of those doubled digits ended up greater than 9, add the digits together (or subtract 9, if that’s your jam).

Take the sum of all the digits and the check digit.

If the total modulo 10 equals 0, the number is valid.

For an example, the number 4012-8888-8888-1881 is a valid Visa-formatted account number, used for testing. You can’t charge it, but it should validate with this algorithm.

Is it a multiple of 10? Yep!

This number checks out, it could possibly be a valid Visa card so we’re clear to make the network request.

Implement

To follow along, you’ll need Node. I’m using pnpm, feel free to use npm or yarn instead. Create a new project:

Exit fullscreen mode

Throw a stub into index.js to get hooked up:

Exit fullscreen mode

Unit tests

Before hopping into the implementation, it’s a good idea to have some unit tests ready to go. Add mocha :

Exit fullscreen mode

Exit fullscreen mode

Now add the following tests to test/test.js :

Exit fullscreen mode

Don’t worry, those aren’t real accounts, just some valid test numbers from here.

As expected, running npm test should confirm that our stub has some work to do:

Exit fullscreen mode

I’m sticking to a functional style for this implementation, wherein instead of mutating state and looping we’ll get to the final result by defining transformations over data.

Split Digits

Exit fullscreen mode

The regular expression uses ^ to match anything that isn’t a digit from 0-9. The trailing g indicates we want to match globally and replace all matches found with nothing (removing it from the string). If omitted, only the first match is replaced and the remaining string is untouched. Then, we split into individual characters, one per digit, and convert them all from characters to numeric values.

Set The Stage

Exit fullscreen mode

To get to our final validation, we’re going to perform a series of transformations on this digit array to reduce it to a final total. A valid number will produce a result that’s a multiple of 10:

Exit fullscreen mode

Get The Total

We already talked this through in English. Let’s take a stab in pseudocode:

Exit fullscreen mode

We’ve got to do that doubling step on the correct numbers in the account number, then transform anything that ended up with multiple digits, then get the total of everything together.

For this step, we can use Array.prototype.slice() to get a subset of the digits array that has everything except for the check digit. Going right-to-left can be achieved with Array.prototype.reverse() :

Exit fullscreen mode

Exit fullscreen mode

Define Transformations

Exit fullscreen mode

This works somewhat like the ternary operator but as a function. Each instance of this is just a specified case of a conditional transform:

Exit fullscreen mode

Wrapping Up

Putting it all together:

Exit fullscreen mode

Check it out with pnpm test :

Exit fullscreen mode

This algorithm is used for a variety of different types of data verification, not just credit card numbers. Maybe you could integrate it into your next project’s design! Adding a checksum to your DB keys can help protect against data transmission errors, and very simple verification like this is easy to get started with.

Challenge

Extend this code to provide a method that can add a correct Luhn checksum to any arbitrary number. The check digit will be the number you need to add to your total to get to multiple of 10.

Credit Card Validator

Credit Card Validator provides validation utilities for credit card data inputs. It is designed as a CommonJS module for use in Node.js, io.js, or the browser. It includes first class support for ‘potential’ validity so you can use it to present appropriate UI to your user as they type.

A typical use case in a credit card form is to notify the user if the data they are entering is invalid. In a credit card field, entering “411” is not necessarily valid for submission, but it is still potentially valid. Conversely, if a user enters “41x” that value can no longer pass strict validation and you can provide a response immediately.

Credit Card Validator will also provide a determined card type (using credit-card-type). This is useful for scenarios in which you wish to render an accompanying payment method icon (Visa, MasterCard, etc.). Additionally, by having access to the current card type, you can better manage the state of your credit card form as a whole. For example, if you detect a user is entering (or has entered) an American Express card number, you can update the maxlength attribute of your CVV input element from 3 to 4 and even update the corresponding label from ‘CVV’ to ‘CID’.

Download

Example

Using a CommonJS build tool (browserify, webpack, etc)

var valid = require(‘card-validator’);

valid.number(value: string, [options: object]): object

You can optionally pass luhnValidateUnionPay as a property of an object as a second argument. This will override the default behavior to ignore luhn validity of UnionPay cards.

You can optionally pass maxLength as a property of an object as a second argument. This will override the default behavior to use the card type’s max length property and mark any cards that exceed the max length as invalid.

If a card brand has a normal max length that is shorter than the passed in max length, the validator will use the shorter one. For instance, if a maxLength of 16 is provided, the validator will still use 15 as the max length for American Express cards.

A fake session where a user is entering a card number may look like:

| Input | Output | Suggested Handling | |||

|---|---|---|---|---|---|

| Value | card.type | isPotentiallyValid | isValid | Render Invalid UI | Allow Submit |

| » | null | true | false | no | no |

| ‘6’ | null | true | false | no | no |

| ’60’ | ‘discover’ | true | false | no | no |

| ‘601’ | ‘discover’ | true | false | no | no |

| ‘6011’ | ‘discover’ | true | false | no | no |

| ‘601’ | ‘discover’ | true | false | no | no |

| ’60’ | ‘discover’ | true | false | no | no |

| ‘6’ | null | true | false | no | no |

| » | null | true | false | no | no |

| ‘x’ | null | false | false | yes | no |

| » | null | true | false | no | no |

| ‘4’ | ‘visa’ | true | false | no | no |

| ’41’ | ‘visa’ | true | false | no | no |

| ‘411’ | ‘visa’ | true | false | no | no |

| ‘4111111111111111’ | ‘visa’ | true | true | no | yes |

| ‘411x’ | null | false | false | yes | no |

valid.cardholderName(value: string): object

The cardholderName validation essentially tests for a valid string greater than 0 characters in length that does not look like a card number.

If a cardholder name is comprised of only numbers, hyphens and spaces, the validator considers it to be too card-like to be valid, but may still be potentially valid if a non-numeric character is added. This is to prevent card number values from being sent along as the cardholder name but not make too many assumptions about a person’s cardholder name.

If a cardholder name is longer than 255 characters, it is assumed to be invalid.

valid.expirationDate(value: string|object, maxElapsedYear: integer): object

The maxElapsedYear parameter determines how many years in the future a card’s expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

expirationDate will parse strings in a variety of formats:

| Input | Output |

|---|---|

| ’10/19′ ’10 / 19′ ‘1019’ ’10 19′ | |

| ’10/2019′ ’10 / 2019′ ‘102019’ ’10 2019′ ’10 19′ | |

| ‘2019-10’ | |

| | |

valid.expirationMonth(value: string): object

valid.expirationYear(value: string, maxElapsedYear: integer): object

expirationYear accepts 2 or 4 digit years. 16 and 2016 are both valid entries.

The maxElapsedYear parameter determines how many years in the future a card’s expiration date should be considered valid. It has a default value of 19, so cards with an expiration date 20 or more years in the future would not be considered valid. It can be overridden by passing in an integer as a second argument.

valid.cvv(value: string, maxLength: integer): object

The cvv validation by default tests for a numeric string of 3 characters in length. The maxLength can be overridden by passing in an integer as a second argument. You would typically switch this length from 3 to 4 in the case of an American Express card which expects a 4 digit CID.

valid.postalCode(value: string, [options: object]): object

The postalCode validation essentially tests for a valid string greater than 3 characters in length.

You can optionally pass minLength as a property of an object as a second argument. This will override the default min length of 3.

Custom Card Brands

Design decisions

Development

We use nvm for managing our node versions, but you do not have to. Replace any nvm references with the tool of your choice below.

List of Credit Card Declined Codes – Error Codes Explained

Declined credit cards are a common occurrence in any business environment, but they are especially common in B2C, high-transaction volume companies.

Whatever point-of-sale system you use, it should deliver a specific code number along with the decline receipt, but that won’t help give you the “why” without having the definitions of those codes.

Having these credit card decline codes on hand helps you provide better customer service by way of a more thoughtful and thorough explanation.

We’ve compiled a list of the most common denial reasons below, and if you can’t find the code here, we recommend contacting your POS provider directly.

List of common credit card declined codes

01 – Refer to issuer

The issuing bank (Visa, Mastercard, etc.) prevented the transaction.

Ask for a separate card to complete the transaction and/or ask the customer to call their credit card bank and figure out why the transaction was declined.

02 – Refer to issuer (special condition)

Just like Code 01, the issuing bank (Visa, Mastercard, etc.) prevented the transaction.

04 – Pick up card (no fraud)

The issuing bank (Visa, Mastercard, etc.) prevented the transaction.

05 – Do not honor

The issuing bank (Visa, Mastercard, etc.) prevented the transaction and is also telling you not to honor the card.

Ask for a separate card to complete the transaction and/or ask the customer to call their credit card bank and figure out why the transaction was declined.

07 – Pick up card, special condition (fraud account)

The issuing bank (Visa, Mastercard, etc.) prevented the transaction because it has flagged this account as fraudulent.

If it’s for a one-time transaction, do not run the card again, and don’t provide any more goods or services for the cardholder. If it was a recurring or scheduled transaction, follow up with your customer to make sure your business wasn’t incorrectly flagged as fraudulent. Ask that they follow up with their bank OR update their account with a newly provided card.

12 – Invalid transaction

The transaction you’re attempting is invalid — e.g. refunding a refund.

Make sure you’re transacting the right payment types and double-check that all payment batches are correctly configured.

13 – Invalid amount

The number field you attempted to transact was invalid. This usually is the result of a typo (negative amount or ineligible symbol).

Double-check what you entered and make sure it wasn’t negative or included incorrect symbols.

14 – Invalid card number

The card number is invalid, and your terminal is having trouble finding the relevant account.

Double-check the account number given and try again.

15 – No such issuer

The card number entered is wrong since it doesn’t start with a 3 (AMEX), 4 (Visa), 5 (MasterCard), or 6 (Discover).

Double-check the card number entered.

19 – Re-enter

An unknown error occurred.

Try it again, and if it continues, contact your merchant provider.

28 – File is temporarily unavailable

A temporary error occurred during the authorization process.

Try it again, and if the problem continues, contact your merchant provider.

41 – Lost card, pick up (fraud account)

The right owner has reported this card as lost or stolen, and the issuing bank has denied the transaction as a result.

Don’t try the transaction again and do not provide any additional goods or services to the cardholder. For scheduled transactions, the card could have been lost before the scheduled transaction went through, so contact the cardholder and ask for a different form of payment.

43 – Stolen card, pick up (fraud account)

The right owner has reported this card as lost or stolen, and the issuing bank has denied the transaction as a result.

Don’t try the transaction again and do not provide any additional goods or services to the cardholder. Make sure you report the transaction attempt to the relevant issuing bank. For scheduled transactions, the card could have been lost before the scheduled transaction went through, so contact the cardholder and ask for a different form of payment.

51 – Insufficient funds

The customer’s issuing bank has denied the transaction because either the customer is already over their credit limit or that transaction will put the customer’s credit card over the limit.

Either ask the customer to call their issuing bank and request a credit limit or request a different form of payment.

54 – Expired card

The expiration date entered is in the past.

Double-check you entered it correctly, ask the customer to confirm the expiration date with their issuing bank, or request an alternate payment method.

This code will appear if you are attempting a transaction and your customer’s card is not configured for that type of transaction.

Have your customer call their issuing bank (the number is typically printed on the back of the credit card) and ask that the transaction be permitted. When the bank confirms it will process correctly, attempt the transaction again.

This code will appear if you are attempting a transaction and your merchant processing account is not properly configured.

Contact your merchant provider and make sure your terminal/POS is set up to receive the type of payment you’re attempting.

This means one of two things: 1. You’re attempting to transact an AmEx card or a Discover transaction and your system doesn’t support them, or 2. A customer tried to pay online with a card that doesn’t support online payments.

For the first reason, call your merchant provider and make sure your terminal/POS supports American Express or Discover transactions. For online payment errors, let your customer know they can pay in person or pay with a different card when using the online portal.

63 – Security violation

The three-digit CVV2 or four-digit CID code on the back of the credit card wasn’t read correctly.

Attempt the transaction again without entering a CVV2/CID number. It should process normally. Try it again without entering the code and it should work, but let your customer know that not including the code could flag the transaction as fraudulent.

65 – Activity limit exceeded

Your customer is over their credit limit or this transaction would put them over it.

Have them use a different transaction method or have them call and request a credit limit adjustment.

85 or 00 – Issuer system unavailable

A temporary communication error occurred.

Try it again. If it doesn’t go through, contact your payment processor.

85 – No reason to decline

There’s no apparent problem, but something still went wrong. This error is sort of a catch-all.

Try it again. If the transaction still won’t go through, contact your payment processor.

91 – Issuer or switch is unavailable

The authorization communication failed for no specific reason.

Try it again. If the transaction still won’t go through, contact your payment processor or the relevant issuing bank.

93 – Violation, cannot complete

There’s a violation on the customer account, and the issuing bank has prevented the transaction.

Ask your customer to call their bank, and if the bank confirms everything is okay on their end, attempt the transaction again. Otherwise, just ask for a different card or payment method.

96 – System error

A temporary error occurred during the transaction.

Wait a minute or two and try again. Contact your payment processor if it still didn’t work.

RO or R1 – Customer requested stop of specific recurring payment

Your customer asked their bank to deny charges from your account.

Stop the recurring payments immediately. Then follow up with the customer to see if the request to stop payment was a mistake.

Invalid Transaction: Declined Code 12 Explained

Few things are more frustrating than having a customer who’s waiting to pay but can’t because of some error code, especially when there is a long line of customers behind them.

Or, if you’re running an eCommerce business, error codes could be dramatically lowering your checkout conversion rates — and you may not even know! Staying on top of error codes and diagnosing them quickly is key to running a successful business.

There are a variety of reasons why your POS may fire a decline code, from fraud to incorrect information, and it’s not realistic to memorize all of the codes and what they mean (although printing out a list of credit cards decline codes and hanging it nearby could be useful).

Today, we’re going to cover the invalid transaction, or declined code 12. Here’s everything you need to know about what it is and what to do about it.

What is declined 12 on a credit card?

Also known as the «invalid transaction» code, a credit card error code 12 is given when the issuing bank does not accept a transaction.

That’s super vague, but it’s true.

The issuing bank is the bank that gave the customer their card, and a declined 12 code is sort of a catch-all for error codes. It doesn’t mean one specific thing, but there are a few common reasons why your POS could be sending it.

Why did the POS give me an invalid transaction message?

Here are a few reasons why you could be getting a credit card code 12:

It could be one or a combination of these that is causing your system to fire an invalid transaction. Double-check that it’s not a user error and go from there.

What to do when you get a decline code 12

Decline code situations are always annoying, but follow these steps to resolve them as quickly as possible.

Step 1: Apologize to the customer.

Even if you’re pretty sure it’s their fault, being cordial goes a long way to making this process less frustrating for both parties.

Step 2: Try running the card again.

Take two! Most people try this first anyway, but just in case you haven’t!

Step 3: Double-check the information.

Take a slow read through the code, expiration date, name, and security code. Ask your customer to repeat it if necessary.

Step 4: Double-check the zip code.

It’s possible the customer moved recently and has accidentally put in the wrong zip code. Ask them politely if there’s another zip code possibility.

Step 5: Request a different card.

If you can’t get the card to work, see if your customer minds switching cards for you.

Step 6: Request an alternative form of payment.

See if they can pay by cash or check. If that isn’t an option, don’t just say sorry! Ask to take their name or give them a more direct phone line.

Chances are they’ll have to call their bank to figure things out, so you want to get them right back to the front of the checkout line when they’ve figured it out.

The last thing you want to do is lose a big sale to a competitor over a system error.

Get the rundown on credit card decline codes

Go here for a complete list of credit card decline codes. This is a great page to bookmark!

And if you are running an eCommerce business and want to customize the responses you give customers according to the error code they receive, Visa has some great automated response suggestions, which you can access here.

Save up to 35% on transaction fees with Tidal

Error codes and messages

Depending on your integration type, there are a number of error codes you can receive. All integrations can receive Generic error codes.

There are also error codes specific for an integration type or payment method:

Generic error codes

This error can have multiple potential causes. Here are some examples:

Cause:

Cause:

Cause: Missing parameter

Solution:

Cause:

Cause: The card number field contains an incorrect value.

Cause:

Cause: Missing user permission.

Solution: Add the Merchant Recurring role to the associated web service user.

Cause: The IBAN might be incorrect.

Cause: Missing txvariant details.

Solution: Check the requestData and pass the details correctly.

Cause: The IBAN might be incorrect.

Cause:

Solution:

Cause:

Cause: Incorrect date of birth format is being passed.

Solution: Check what is being passed in the dateOfBirth parameter.

Cause: The billingAddress object does not contain all the required fields.

Solution: Check the required parameters in the API Explorer.

Cause: The deliveryAddress is ‘null’ or there is an error in the delivery address format.

Cause: The shopperName is ‘null’.

Cause:

Cause: shopperReference is ‘null’.

Cause: The phoneNumber or telephoneNumber is ‘null’.

Cause: The recurring object is not passed correctly.

Solution: Check the requestData and make sure that the recurring object is correct.

Cause:

Solution: Check variable/input passed into field.

Cause:

Solution: Check if the reference parameter is passed correctly.

Cause:

Solution: Check variable/input.

Cause:

Cause:

Solution: Pass all required parameters or make sure that you pass data in each parameter.

Cause: StateOrProvince field is missing in delivery address and is required for the selected country.

Cause:

Solution:

Cause: Not passing numeric or valid values.

Solution: Check what variable or input is being passed into the CVC field.

Cause:

Solution:

Cause:

Cause: Merchant server-side date/time is not set up correctly. For example, the merchant server side is set up to 1975 when it is 2020, or the date isn’t in a plus or minus 24 hour range as of today.

Solution: Check the server-side date/time configuration.

Cause:

Solution: If you are seeing this using a plugin, generate a new web service user with the relevant permissions.

Cause: Check if the parameters sent are formatted correctly in JSON.

Solution: Read through the requestData to find the error.

Cause: shopperReference is empty, doesn’t exist or is not found.

Cause: shopperEmail is empty, doesn’t exist or is not found.

Cause: The selected brand is not equal to the brand on the stored token, or empty.

Cause: Not found in Recharge. Qiwi can also throw this error if recurring contract isn’t found.

Cause: Value is empty or ‘null’, or the name doesn’t match with the recurringDetail name.

Cause:

Solution:

Cause:

Cause: The previous recurringDetail token was not saved correctly or does not exist.

Cause: The shopperIP is empty.

Cause:

Cause:

Cause: The reference contains more than 80 characters.

Cause:

Cause:

Коды ошибок Visa/MasterCard/МИР

В данной статье собраны коды ошибок действующих банков-эквайеров.

Часто встречающиеся ошибки:

Код 05 – отказ эмитента без указания причины

Код 17 – отказать, отклонено пользователем карты

Код 41 – утерянная карта

Код 43 – украденная карта

Код 51 – недостаточно средств для проведения операции

Код 57 – недопустимый тип операции для данного типа карты (например, попытка оплаты в магазине по карте предназначенной только для снятия наличных)

Код 61 – превышение максимальной суммы операции или количества попыток для данной карты; превышен лимит на терминале продавца; недостаточно средств на счете продавца, в случае выплат (более точное описание смотрите ниже, исходя из обслуживающего банка)

Код 62 – заблокированная карта

Код 65 – превышение максимального количества операции для данной карты

Код 83 – ошибка сети (технические проблемы)

Код 91 – эмитент недоступен (технические проблемы на стороне банка-эмитента)

Код 96 – системная ошибка/невозможно связаться с банком, который выдал карту (требуется сверка с эквайером)

Полный список кодов ПАО « Промсвязьбанк » :

| Result Code | Description | Описание |

| 0 | Approved | Операция прошла успешно |

| 1 | Call your bank | Позвоните в свой банк |

| 3 | Invalid merchant | Недействительный продавец |

| 4 | Your card is restricted | Ограничение в проведении операции на стороне эмитента |

| 5 | Transaction declined | Операция отклонена без указания причины |

| 12 | Invalid transaction | Недействительная операция, возможно ошибки в параметрах запроса к платёжной системе |

| 13 | Invalid amount | Недопустимая сумма |

| 14 | No such card | Такая карта не существует |

| 15 | No such card/issuer | Нет такой карты / эмитента |

| 20 | Invalid response | Неверный ответ |

| 30 | Format error | Ошибка в параметрах запроса к платёжной системе |

| 41 | Lost card | Карта утеряна (статус установлен у эмитента) |

| 43 | Stolen card | Карта украдена |

| 51 | Not sufficient funds | |

| 54 | Expired card | Срок действия карты истёк |

| 55 | Incorrect PIN | Неверный PIN-код |

| 57 | Not permitted to client | Операция не разрешена для клиента (как правило, о тказ приходит со стороны платёжной системы) |

| 58 | Not permitted to merchant | Не разрешено продавцу (заблокирован терминал) |

| 61 | Exceeds amount limit | Сумма операции превысила допустимый лимит (также, возможен отказ от платёжной системы) |

| 62 | Restricted card | Запрещённая карта |

| 63 | Security violation | Нарушение безопасности |

| 65 | Exceeds frequency limit | Превышен лимит |

| 75 | PIN tries exceeded | Превышено количество попыток ввода PIN-кода |

| 76 | Wrong PIN,tries exceeded | Неверный PIN-код, количество попыток превышено |

| 82 | Time-out at issuer | Тайм-аут при соединении с эмитентом |

| 83 | Transaction failed | Транзакция неуспешна |

| 86 | Unable to verify PIN | Невозможно проверить PIN-код |

| 89 | Authentication failure | Ошибка аутентификации |

| 91 | Issuer unavailable | Эмитент недоступен |

| 93 | Violation of law | Операция отклонена. Держателю необходимо обратиться в свой банк |

| 95 | Reconcile error | Возникает, когда операция была уже проведена. |

| 96 | System malfunction | Системная ошибка \ Возможно ошибки в параметрах запроса к платёжной системе |

| -2 | Bad CGI request | Неверно сформирован запрос к платёжному шлюзу |

| -3 | No or Invalid response received | Платёжный шлюз вовремя не получил ответ. Статус операции при этом может быть успешным или неуспешным. |

| -4 | Server is not responding | Сервер не отвечает |

| -5 | Connect failed | Сбой соединения |

| -8 | Error in card number field | Ошибка в поле номера карты |

| -9 | Error in card expiration date field | Введена неверная дата срока действия карты |

| -10 | Error in amount field | Ошибка в поле суммы |

| -11 | Error in currency field | Ошибка в поле валюты |

| -12 | Error in merchant terminal field | Некорректный запрос к платежному шлюзу |

| -17 | Access denied | Отказано в доступе (Возможно ошибка при формировании P_SIGN) |

| -18 | Error in CVC2 or CVC2 Description fields | Ошибка в поле CVC2 |

| -19 | Authentication failed | Аутентификация прошла неуспешно (3d-secure), возможны другие причины. |

| -20 | Expired transaction | Время проведения операции превышает значение параметра TIMESTAMP |

| -21 | Duplicate transaction | Отправлен повторный запрос с идентичными параметрами |

| 70001 | Not sufficient funds | Недостаточно средств на счете. |

Полный список кодов ПАО Банк «ФК Открытие»:

| Result Code | Description | Описание |

| 00 | Approved | Успешная транзакция |

| 01 | Refer to card issuer | Обратитесь к эмитенту карты |

| 02 | Refer to card issuer, special condition | Обратитесь к эмитенту карты, особое условие |

| 03 | Invalid merchant or service provider | Недействительный идентификатор продавца |

| 04 | Pickup card | Изъять карту |

| 05 | Do not honor | Транзакция была отклонена эмитентом без объяснения причин |

| 06 | Error | Эмитент карты вернул ошибку без дополнительных объяснений |

| 07 | Pickup card, special condition (other than lost/stolen card) | Изъять карту, специальные условия |

| 08 | Honor with identification | Не пройдена идентификация, проблема с идентификацией |

| 09 | Request in progress | Выполняется запрос |

| 10 | Approved for partial amount | Одобрено для частичной суммы |

| 11 | Approved, VIP Approved, VIP program | Одобрено для VIP, программа VIP |

| 12 | Invalid transaction | Запрошенная транзакция не поддерживается или недействительна для представленного номера карты |

| 13 | Invalid amount | Сумма превышает лимиты, установленные эмитентом для данного типа транзакции |

| 14 | Invalid card (no such number) | Эмитент указывает, что эта карта недействительна. |

| 15 | No such issuer | Номер эмитента карты недействителен |

| 16 | Approved, update track 3 | Утверждено, обновить |

| 17 | Customer cancellation | Отмена клиентом |

| 18 | Customer dispute | Открыт спор с клиентом |

| 19 | Re-enter transaction | Клиент должен повторно отправить транзакцию |

| 20 | Invalid response | Неверный ответ |

| 21 | No action taken | Никаких действий не предпринимается. Эмитент отказался без других объяснений |

| 22 | Suspected malfunction | Предполагаемая неисправность |

| 23 | Unacceptable transaction fee | Неприемлемая комиссия за транзакцию |

| 24 | File update not supported | Обновление файла не поддерживается |

| 25 | Unable to locate record | Невозможно найти запись |

| 26 | Duplicate record | Дублирующая запись |

| 27 | File update edit error | Ошибка редактирования обновления файла |

| 28 | File update file locked | Файл/обновления файла заблокировано |

| 29 | not used | не используется |

| 30 | Format error | Ошибка формата |

| 31 | Bank not supported | Банк не поддерживается коммутатором |

| 32 | Completed partially | Завершено частично |

| 33 | Expired card, pick-up | Срок действия карты истек |

| 34 | Issuer suspects fraud, pick-up card | Эмитент карты подозревает мошенничество |

| 35 | Contact acquirer, pick-up | Обратиться к эмитенту карты |

| 36 | Restricted card, pick-up | Ограничено эмитентом карты |

| 37 | Call ECHO security, pick-up | Обратитесь в службу безопасности |

| 38 | PIN tries exceeded, pick-up | Количество попыток получения PIN-кода превышает лимиты эмитента |

| 39 | No credit account | Нет кредитного счета |

| 40 | Function not supported | Запрошенная функция не поддерживается |

| 41 | Pickup card (lost card) | Карта была утеряна |

| 42 | No universal account | Нет универсальной учетной записи |

| 43 | Pickup card (stolen card) | Карта была украдена |

| 44 | No investment account | Нет инвестиционного счета |

| 45 | 50 not used | не используется |

| 51 | Not sufficient funds | Недостаточно средств на карте (только для оплат) |

| 52 | No checking account | Нет текущего счета |

| 53 | No savings account | Нет сберегательного счета |

| 54 | Expired card | Срок действия карты истек |

| 55 | Incorrect PIN | Неправильный PIN-код держателя карты |

| 56 | No card record | Нет такой карты |

| 57 | Transaction not permitted to cardholder | Операция не разрешена держателю карты. Карта не разрешена для запрошенного типа транзакции. |

| 58 | Transaction not permitted on terminal | Транзакция не разрешена на терминале. Продавцу запрещен этот тип транзакции (заблокирован терминал; сработало ограничение и т.д. необходимо уточнять подробности у эквайера) |

| 59 | Suspected fraud | Предполагаемое мошенничество |

| 60 | Contact ECHO | Связаться с службой безопасности |

| 61 | Exceeds withdrawal limit | |

| 62 | Restricted card | Карта заблокирована |

| 63 | Security violation | Нарушение безопасности. Карта заблокирована |

| 64 | Original amount incorrect | Неверная исходная сумма |

| 65 | Activity count limit exceeded | Превышено допустимое количество ежедневных транзакций |

| 66 | Call acquirer security | Связаться со службой безопасности эквайера |

| 67 | not used | не используется |

| 68 | Response received too late | Ответ получен слишком поздно |

| 69 | 74 not used | не используется |

| 75 | PIN tries exceeded | Превышено допустимое количество попыток ввода PIN-кода |

| 76 | Invalid «to» account | Неверный счет. Дебетового счета не существует |

| 77 | Invalid «from» account | Недействительный счет. Кредитный счет не существует |

| 78 | Invalid account specified (general) | Связанная учетная запись с номером карты недействительна или не существует |

| 79 | Already reversed | Уже отменено |

| 80 | Visa transactions: credit issuer unavailable | Операции с Visa: эмитент недоступен |

| 81 | PIN cryptographic error found | Обнаружена криптографическая ошибка PIN-кода |

| 82 | Negative CAM, dCVV, iCVV, or CVV results | Некорректный CAM, dCVV, iCVV или CVV |

| 83 | Unable to verify PIN | Невозможно проверить PIN-код |

| 84 | Invalid authorization life cycle | Просроченная авторизация |

| 85 | not used | не используется |

| 86 | Cannot verify PIN | Невозможно проверить PIN-код |

| 87 | Network Unavailable | Сеть недоступна |

| 88 | Invalid CVC2 | Ошибочно введенный cvc2 |

| 89 | Ineligible to receive financial position information | Невозможно получить финансовую информацию |

| 90 | Cut-off in progress | Отключение в процессе |

| 91 | Issuer or switch inoperative | Банк-эмитент недоступен |

| 92 | Routing error | Ошибка маршрутизации |

| 93 | Violation of law | Нарушение закона |

| 94 | Duplicate transaction | Дублирующая транзакция |

| 95 | Reconcile error | Ошибка согласования/ошибка при расчетах с МПС/НСПК |

| 96 | System malfunction | Произошла системная ошибка |

| 97 | not used | не используется |

| 98 | Exceeds cash limit | Превышен денежный лимит |

| -2 | Bad CGI request | Запрос не прошел CGI-проверку |

| -3 | No or Invalid response received | Хост эквайрера (NS) не отвечает |

| -4 | Server is not responding | Нет соединения с хостом эквайрера |

| -5 | Connect failed | Ошибка соединения с хостом эквайрера (NS) во время обработки транзакции |

| -6 | Configuration error | Ошибка настройки модуля e-Gateway |

| -7 | Incorrect response from the acquirer host | Некорректный ответа хоста эквайрера (NS), например, отсутствуют обязательные поля |

| -8 | Error in card number field | Ошибка в поле «Card number» запроса |

| -9 | Error in card expiration date field | Ошибка в поле «Card expiration date» запроса |

| -10 | Error in amount field | Ошибка в поле «Amount» запроса |

| -11 | Error in currency field | Ошибка в поле «Currency» запроса |

| -12 | Error in merchant terminal field | Ошибка в поле «Merchant ID» запроса |

| -13 | System error | IP-адрес источника транзакции (обычно IP торговца) не соответствует ожидаемому |

| -14 | No connection | Нет соединения с PIN-клавиатурой Интернет-терминала либо программа-агент на компьютере/рабочей станции Интернет-терминала не запущена |

| -15 | Error in the «RRN» field of the request | Ошибка в поле «RRN» запроса |

| -16 | Another transaction is in progress on the terminal | На терминале выполняется другая транзакция |

| -17 | The terminal is denied access to the e-Gateway module | Терминалу отказано в доступе к модулю e-Gateway |

| -18 | Error in the «CVC2» or «CVC2 Description» field of the request | Ошибка в поле «CVC2» или «CVC2 Description» запроса |

| -19 | Error in request for authentication information or authentication failed | Ошибка в запросе на аутентификационную информацию либо аутентификация неуспешна |

| -20 | Permissible time interval exceeded | Превышен допустимый временной интервал (по умолчанию – 1 час) между значением поля «Time Stamp» запроса и временем модуля e-Gateway |

| -21 | Transaction has already been completed | Транзакция уже выполнена |

| -22 | Transaction contains invalid authentication information | Транзакция содержит ошибочную аутентификационную информацию |

| -23 | Error in transaction context | Ошибка в контексте транзакции |

| -24 | Inconsistency in the context of a transaction | Несоответствие в контексте транзакции |

| -25 | Transaction aborted by user | Транзакция прервана пользователем |

| -26 | Invalid BIN of the card | Неверный BIN карты |

| -27 | Seller name error | Ошибка в имени продавца |

| -28 | Error in additional data | Ошибка в дополнительных данных |

| -29 | Error in authentication link (damaged or duplicated) | Ошибка в ссылке аутентификации (повреждена или дублируется) |

| -30 | Transaction was rejected as fraudulent | Транзакция отклонена как мошенническая |

| -31 | Transaction in progress | Транзакция в процессе выполнения |

| -32 | Re-declined transaction | Повторная отклоненная транзакция |

| -33 | client authentication in progress | Транзакция в процессе аутентификации клиента с помощью авторизации случайной суммы или одноразового случайного кода |

| -34 | MasterCard Installment транзакция в процессе выбора пользователем способа оплаты | |

| -35 | MasterCard Installment транзакция в процессе выбора пользователем способа оплаты была отклонена автоматически после превышения лимита времени на эту операцию | |

| -36 | MasterCard Installment транзакция в процессе выбора пользователем способа оплаты была отклонена самим пользователем |

Полный список кодов АО «Банк Русский Стандарт»:

Коды отказов платежных систем Visa, MasterCard, МИР (общее описание)

Developer Hub

Extended Payment API

Orders

Shopping Context

Shoppers

Catalog

Subscriptions

Wallets

Errors

Resources

Test Data & Codes

Guides & Tools

Payment & Processor Errors

The following errors can be returned in response to requests related to payment processing, including Order, Shopping Context, and Subscription requests.

Exceeded maximum fraction digits for currency [USD]. Maximum is [2].

Payment processing failure because the authorization has already been reversed.

Payment processing failure due to invalid amount for this transaction.

Payment processing failure because the authorization has expired.

Authorization must be performed before capture.

Payment processing failure because the authorization was not found.

Your payment request could not be successfully completed.

Your payment request could not be successfully completed.

Your payment request could not be successfully completed.

Your payment request could not be successfully completed.

Payment processing failure due to an unspecified error. Please contact the issuing bank.

The card is lost or stolen.

Your payment request could not be successfully completed.

Retry the transaction using a different card or decline the transaction.

Shopping cart or shopping cart parameters are required.

The cart contains CDoD but no item in the cart supports CDoD.

Changing SKU for subscription is not supported.

Credit card details decryption failed due to invalid input.

Credit card details decryption failed due to invalid public key.

Credit card details decryption failed.

Coupon code is required.

Coupon was not found.

Only one coupon can be used for each order.

Shopper credit card cannot contain both plain and encrypted details.

Correct the shopper details and resubmit.

Credit card encrypted number is required.

Add the encrypted card number and resubmit.

Credit card encrypted security code is required. Add the encrypted security code and resubmit.

The Currency Code passed in the request was not found.

Custom parameter was not found.

Payment processing failure due to CVV error.

Correct the CVV code and retry the transaction.

Payment processing failure due to issuing bank decline. Try another payment method or wait 24 hours before trying again.

The cart contains EDW but no item in the cart supports EDW.

The shopping cart is empty.

The parameters specified to the service lead to an empty result.

Expected total price does not match the calculated total price.

or

Transaction could not be completed due to unsupported currency

Your payment request could not be successfully completed.

Correct the expiration date and retry. If the transaction still fails, retry with a different payment method or decline the transaction.

Internal processing error, please contact support.

A general payment failure has occurred.

Your payment request could not be successfully completed.

Payment processing failure due to high risk.

Subscription Charge creation failure since the subscription

Payment processing failure due to incorrect information.

Description will contain additional information about the specific error.

Payment processing failure due to incorrect setup.

Your payment request could not be successfully completed.

Retry the transaction at a later date, use a new payment method or decline the transaction.

There are not enough funds in your account to issue this refund, please contact [email protected]

Invalid affiliate ID.

Payment processing failure due to invalid amount for this transaction.

The bank country passed in the request is invalid.

The cancellation reason passed in the request is invalid.

Payment processing failure due to invalid card number.

Correct the card number and retry the transaction. If the transaction still fails, try a new payment method or decline the transaction.

Payment processing failure due to invalid card type.

Correct the card number and retry the transaction. If the transaction still fails, try a new payment method or decline the transaction.

Updating subscription failed due to invalid currency code.

The custom parameter passed in the request is invalid.

One or more parameters specified to the service are invalid.

The IP address passed in the request is invalid.

The number of shopper payment methods is invalid.

Page name is invalid or missing.

Payment processing failure due to invalid PIN or password or ID error.

The Shopper ID passed in the request is invalid.

Invalid SKU parameter.

Invalid step field.

Payment processing failure because this transaction is not allowed by the issuer.

Transaction type is invalid.

Note: HTTP status is 403 Forbidden.

The VAT ID passed in the request is invalid.

Invoice has already been refunded.

Invoice has already been fully refunded.

The invoice ID passed in the request was not found.

License key regeneration errors.

Payment processing failure because card limit has exceeded.

Retry the transaction later, use a new payment method, or decline the transaction.

Missing parameter key or value.

Shopper has multiple payment methods, but none is selected.

Correct the payment method and resubmit.

The total amount is negative.

Next charge amount is required.

Next charge currency is required

The next charge amount passed in the request is negative.

There are no available processors for the specific request.

Shopper not found for subscription ID

Partial refund failed because the given amount must be greater than zero.

The quantity passed in the request is 0 or negative.

Order invoice or subscription ID is required.

The order ID passed in the request was not found.

The partial refund amount is required.

Simultaneous usage of invoice refund amount and SKU refund amount parameters is not allowed.

SKU does not relate to specified invoice.

SKU amount is invalid.

Partial refund failed because only financial transactions which contain exactly one sku can be partially refunded.

Invoice cannot be partially refunded.

SKU amount is required for partial refunds.

SKU amount exceeds maximum amount allowed for that SKU.

Payment info is required.

Contact Merchant Support to issue this refund.

Payment processing failure because the attempted operation is not supported for this payment method.

Custom plan subscriptions are not supported in PayPal. Please choose an alternative payment method.

Updating PayPal subscription failed due to data mismatch.

Multiple subscriptions are not supported in PayPal. Please choose an alternative payment method.

Persisted shopping context is not found.

Payment processing failure. The card has been reported lost or stolen and should be removed from use.

Plan change with more than one SKU.

Payment processing failure due to invalid amount for this transaction.

Validate the amount submitted is correct and resubmit. If the transaction still fails decline the transaction.

Payment processing failure due to duplication. The transaction is a duplicate of a previously submitted transaction.

Payment processing failure due to an unspecified error returned. Retry the transaction and if problem continues contact the issuing bank, or decline the transaction.

Payment processing failure due to timeout.

Retry the transaction.

A general payment failure has occurred for this refund.

A failure has occurred. Please contact BlueSnap support for further assistance.

Retry the transaction.

Transaction is not valid for refund as transaction has not been cleared yet. Please wait 3-7 days and try again.

Another refund request for this invoice is currently in process. Please wait for it to finish before submitting new request.

Refund amount cannot be more than the refundable order amount.

Correct amount and resubmit.

Refund amount must be greater than 0.

Correct the amount and resubmit.

The refund couldn’t be issued since the original order has a zero total amount

The time limit to perform a refund on this transaction has expired.

The refund couldn’t be issued since the original order doesn’t contain any refundable items.

Payment processing failure due to restricted card.

Payment Error Codes

| CODE | TEXT | DESCIPTION | INTEGRATION SUGGESTIONS | OTHER SUGGESTIONS |

|---|---|---|---|---|

| I00001 | Successful. | The request was processed successfully. | ||

| I00002 | The subscription has already been canceled. | The subscription has already been canceled. | ||

| I00003 | The record has already been deleted. | The record has already been deleted. | ||

| I00004 | No records found. | No records have been found that match your query. | ||

| I00005 | The mobile device has been submitted for approval by the account administrator. | The mobile device was successfully inserted into the database. | ||

| I00006 | The mobile device is approved and ready for use. | The mobile device was successfully registered and approved by the account administrator. | ||